Embracing Tax Season with Confidence: A Guide for Business Owners

April 11th, 2024 | 6 min. read

By Kelli Lewis

Does the mere mention of tax season send a shiver down your spine? You’re not alone in the battle against piles of receipts, complex deductions, and the looming deadline.

At Patrick Accounting, we understand the intricacies of tax season from the inside out. With years of experience supporting businesses like yours, our team is adept at understanding the complexities of tax laws, ensuring you’re well-prepared and confident. We’ve seen firsthand the stress it puts on business owners like you. But here’s a little secret: it doesn’t have to be that way.

In this guide, we’ll demystify the tax process, offering actionable strategies and insights to transform your tax season from a source of anxiety to an opportunity for financial empowerment. How do we turn tax season from a nightmare into something—well, it’s not exactly fun—but definitely less scary? It starts with preparation, understanding, and a little bit of strategy.

What Business Taxes Do I Need to Pay?

First, it’s crucial to understand the basics of what taxes your business is responsible for. It sounds simple, but you’d be surprised how many businesses overpay because they’re unaware of what they do and don’t need to pay.

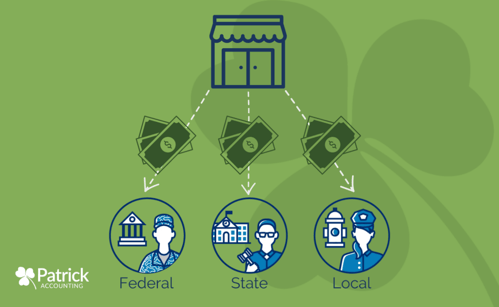

Identifying Federal, State, and Local Tax Obligations

Whether you’re running a coffee shop or a digital agency, you’ve got taxes to pay. And it’s not just about the IRS.

Alongside federal taxes, you’ve got state and local taxes to think about, which can vary depending on where your business is located. This could mean anything from sales taxes to property taxes.

How your business is structured will dictate your state income tax obligations. For example, corporations are taxed separately from the owners, while sole proprietors report their personal and business income taxes using the same form.

The trick is to do a bit of homework to figure out exactly which taxes apply to you. Getting this step right is crucial to avoid any unwelcome surprises down the line.

Avoid Common Tax Mistakes Made by Businesses

Tax mistakes can happen to the best of us. The most common example is when businesses forego available deductions and credits. Whether it’s missing out on office supplies, travel expenses, or even certain types of software subscriptions, these overlooked expenses can add up, costing you more in taxes than necessary.

Keep a Sound Set of Books

Having a reliable and consistent solution for knowing where your money is going is crucial. Paying business-related expenses out of your business accounts and your personal expenses out of your personal accounts is the best place to start. We also recommend starting with a reliable set of books that is being regularly maintained.

Are You Misclassifying Your Workers and Don’t Know It?

Another frequent error is the misclassification of workers. It’s easy to confuse employees and independent contractors, but the IRS has strict rules about the distinction. Getting it wrong means you could be on the hook for back payroll taxes and penalties.

Deadlines Approach Faster Than You Think

Don’t forget about deadlines either. Filing taxes late or missing estimated tax payments throughout the year can result in penalties and interest charges that grow over time. There are many more deadlines besides your personal income tax return date of April 15th. You have due dates all the time and having a good handle on all of the requirements as well as when they are due is crucial to not letting something slip through the cracks.

Keeping an eye on the details can save you a lot of headaches. But it’s not just about avoiding mistakes; it’s about making the most of your tax situation.

Effective Record-Keeping Strategies for Tax Season

All those receipts you’re stashing away (or losing) are mini-goldmines for deductions. We’ve got neat tools and tips to make record-keeping a breeze.

Digitizing Receipts and Financial Documents

Gone are the days of shoeboxes filled with faded receipts. Welcome to the era of digitization.

By converting your receipts and financial documents into digital format, you’re not only saving space but also making your life a whole lot easier come tax time. There are plenty of apps and tools out there designed to help you snap, store, and organize your financial bits and pieces.

This means less time sifting through paper and more time focusing on what you do best – running your business.

Any money spent for the business you should have a receipt for. We use a product called Dext for this. It allows us to connect each transaction in your books to a receipt so that we can substantiate deductions on your tax return in case of an IRS audit.

There are a couple of other apps that some of our clients use. Expensify and Bill are two great options depending on your particular situation.

Efficient Tax Record Management

Having a good tax record management system is like hiring a virtual assistant for your finances. For your business, this means making sure you have a sound set of books that is accounting for everything you are spending money on your business.

If it is legitimately related to the operation of your business, make sure you are spending the money with company funds. You know that meal with your wife for date night is not related to the business, but the meal with your banker to discuss an upcoming equipment purchase you need to make is. Remember to use common sense.

You know right from wrong, but if you aren’t sure, here is a guide for some common business deductions.

Next, make sure you have a place for all of the tax documents you receive. Having a simple Dropbox, One Drive, Google Drive, etc. folder with a year in it is a good place to put everything. The more digital this is, the better.

A cloud location makes it accessible wherever you are and is easy to provide to your accountant come tax time. The W-2, 1099, charitable donation receipts, and brokerage statements you receive in January and February each year can all simply go to one place.

If you are working with an accountant most should have an online account login to send this information to, and for them to communicate with you on anything else they may need.

Year-Round Tax Planning for Business Owners

Waiting until the last minute is a recipe for stress.

Quarterly Tax Check-ins: A Proactive Approach

Why wait until the end of the year to think about taxes? Adopting a quarterly tax check-in routine means you’re keeping a steady eye on your finances, making adjustments as needed.

This proactive approach helps you avoid surprises and ensures you’re always on the right track. Make sure your withholding is in line with your anticipated tax bill in the spring and that you have a plan for where you are saving for the tax man if you don’t have withholding or anticipate owing more than you had planned.

We are a profit-first firm and creating a plan for the tax man starts right away. It relieves a lot of stress to know that your taxes are adequately planned and money is being put aside regularly. Feeling in control makes the whole tax process feel less overwhelming. Think of it as regular maintenance for your business’s financial health – a little effort along the way can save a lot of trouble down the road.

Creating a Tax-Saving Strategy

Saving on taxes isn’t just about cutting corners; it’s about smart planning. Whether it’s putting money into a retirement plan or making strategic purchases, there are strategies that can help reduce your taxable income and bolster your business’s financial future.

It’s about finding the right balance between saving on taxes today and setting yourself up for success tomorrow. Remember, a good strategy is always tailored to your unique business goals and financial situation.

How to Strategize Business Deductions for Tax Benefits

Timing Your Business Expenses Wisely

Timing is everything. Knowing when to make those big purchases or how to finance that purchase can significantly impact your tax bill.

For instance, if you anticipate a higher income this year and a potential drop next year, it might make sense to accelerate some of your planned expenses into the current year. This can help lower your taxable income now when it might save you more in taxes.

Conversely, if you expect next year to be more profitable, delaying certain expenses could be beneficial. It’s all about understanding your business cycle and leveraging that knowledge to make informed decisions.

While timing can be a powerful tool, the primary focus should always be on making purchases that genuinely benefit your business.

A good practice is to review your financials regularly and to understand and know where your money is going. Having a plan for what is coming and going out both personally and for your business is crucial to your overall financial freedom.

Remember, it’s not about spending more to get more deductions. It’s about strategically managing the money you already have and making the best use of that money (which includes the tax consequence for the money you already are spending).

The Secret Ingredient: You Don’t Have to Go It Alone!

Do all things taxes cause a lot of stress? Let’s make it a thing of the past and embrace tax season with confidence. Contact us today if you’re tired of dreading everything related to your taxes and are ready to take control.

Patrick Accounting doesn’t just help you survive all of your tax stuff; we help you thrive through it. Let’s make this the year taxes become just another part of your success story.

Topics: