Once again, I’m sitting in my home office at night, much like it all started…

In December of 2003, I started Patrick Accounting. Back then, my office was nothing more than a small corner in my house – just me, a desk, and a vision. Fast forward to today, 20 years later, and I’m struck by the growth and evolution that stemmed from that humble corner.

How Things Started

I had lost my job and was looking for a new one. My severance was fairly substantial, but we had just had our first child, so the situation seemed dire. Mandy, my wife, was working as a PTA at Methodist North and told me about her co-worker who was in a tough spot with taxes. Her dad had passed away, and there were overdue tax notices and a pending tax return. Mandy asked if I could help her, and I agreed. We settled on a hundred bucks for the job. But then it hit me – I didn’t have fancy tax software, a computer, or even a printer. I was about to tackle this tax return the old-school way, much like the first time I had ever done one.

I needed to renew my CPA license at the same time and went down to the Pak Mail office on the corner of Macon and Houston Levee Rd. The guy working there noticed my envelope and said, “Hey, you’re an accountant. I’ve been looking for one.” It turned out to be Nick Bhula, owner of the Pak Mail franchise. He had just moved here and was about 60 days into his new place. Nick used to own a Baskin-Robbins franchise in Jackson and he was in the process of selling it. He mentioned that he already had an accountant in Jackson, but was looking for one here. He explained that the previous accountant helped him with bookkeeping and some taxes, but he was paying them around three or four hundred bucks a month. Nick liked the idea of having someone local to help him out.

With my envelope in hand, I thought, “I could help with that.” As I mentioned, I was still on the lookout for a job since I had been let go by Deloitte in October. It wasn’t an easy time for me, struggling to balance family life, being a good dad, and finding a job that I loved. So, helping Nick with his accounting seemed like a good side job for me. And just like that, I had started a business.

Connections and Compassion

Not too long after, Nick mentioned that the Allstate guy next door, Clay Farrell, had just bought that franchise and needed an accountant. I reached out to him, introduced myself as the accountant Nick recommended, and asked about his needs. Clay shared that he needed help with tax returns, monthly financials, and eventually, payroll as he hired more people. I offered my assistance, and things fell into place.

He mentioned to me that he’s part of a BNI group, a gathering of business owners trying to figure things out. Clay suggested I join him at the meeting at McAllister’s on Trinity and Germantown Parkway. Intrigued, I attended and realized there were many business owners just starting out (like me) looking for help with taxes, bookkeeping, and accounting. It got me thinking that maybe I could help these folks too.

And so, I found myself exploring a path I hadn’t touched before—offering help with taxes and accounting to fellow business owners. It was an unexpected turn of events that brought many new opportunities for me.

Another opportunity arose when Mandy was attending a women’s study group. A lady sitting beside her started crying and tearfully expressed that she believed her husband’s business partner had passed away and they didn’t know what to do. “Did anyone know of an accountant?” she pleaded. Bewildered, Mandy told her, “Well, my husband is an accountant,” and promptly came home to ask if I could help her. With a newborn baby in the picture and tasks to complete before the year-end, I agreed to meet with them, even though I had little experience with their specific tax forms and QuickBooks.

Upon visiting their offices, I dove into QuickBooks and quickly realized that something seemed off. Despite the confusion, they needed immediate assistance with payroll reports and were willing to pay $100 an hour. I had never dealt with any of this, but I was determined to learn and help them. As I spent hours and hours on tasks like W2s, a Tennessee unemployment return, and a Mississippi withholding year-end, I discovered the tangled web of their financial records. The situation escalated when I recommended an attorney, and it became clear that we were dealing with a complex case spanning multiple years.

Building a Client Base

Around the same time in January, I found myself reflecting on the progress made. With three or four clients on board, I realized that this venture was going to be a gradual process. Contemplating my options, I told Mandy, “I’m going to make a go of this, at least for a few months. But I will still look for a job until the coverage runs out and we figure out what we’re going to do.”

As part of this decision, I embraced networking opportunities, particularly through BNI, and within the first few days, I gained several clients whose names you might recognize—Morris Nutt, Joe Bailey at House Call Home Inspection, and Pat Kolwaite at Mid-South Chiropractic. This marked the beginning of an exciting journey, and I found myself handling about 20 tax returns and helping with internal bookkeeping with QuickBooks support in the spring of 2004.

Through a friend of a friend, I was referred to a graphic designer. This sparked the idea of creating a mailing list to spread the word about my tax practice. This first stab at marketing was not glamorous. We printed around 3,000 postcards, laid them out on our bedroom and living room floors, stamped each one individually, affixed labels, and drove them to the post office. Out of all those, we got about 10 replies. But it led us to clients like Doug’s Quality Lawn Care and Martha Wilson, both blessings in disguise. Despite my initial lack of experience, we managed to complete about 20 tax returns in that first year, thanks to the support of friends, family, and word-of-mouth referrals.

Growing the Practice

Handling tax returns at a rate of $100 per hour, I reached a point in April of 2004 where the idea of working from home became overwhelming. Wanting to expand, hire employees, and establish a more structured routine, I decided it was time to get an office. Mandy’s practical condition was clear: no office until we had enough rent to cover five months at $600 per month.

Through BNI, I connected with Ron Townsend, who had a 600-square-foot space available. If you can’t imagine that size, it’s about the same size as my current individual office today. This became our new headquarters in May 2004, where my mother-in-law Cathy, with aspirations of starting her own travel business, joined the team and worked 50% for me and 50% for herself. We happily moved in and bought a few pieces of furniture. Cathy brought in her old desk, a significant piece that stayed with us for a long time. A big blonde monstrosity measuring six by four feet, the desk became a familiar sight to many who worked with us in the various future office locations.

In the summer of that year, we welcomed a friend of Cathy and mine, Sue Blose. These wonderful ladies played a crucial role in helping with tasks like keying in checks, bookkeeping, learning payroll, and even preparing some basic tax returns. Their willingness to tackle anything and learn everything was a tremendous blessing. By August 2004, we hired our first real accountant, Traci Penland. She had recently relocated to Memphis and was on the lookout for a part-time job. Being an accountant, I hired her on an hourly basis, even though truthfully, I couldn’t really afford her. However, she was the only accountant I knew who could provide the assistance I needed at the time. Over the course of about a year, maybe a little more, she worked with us, proving to be a blessing with her exceptional skills and intelligence.

Growing Pains

As the business grew, we encountered challenges in managing finances. In the first year, we billed around $100,000, resulting in a profit of about $60,000 after factoring in office expenses and a couple of employees. By May 2005, we found ourselves bursting at the seams, with four employees crammed into our 600-square-foot space. Our working conditions weren’t ideal, sharing one large room and a makeshift conference room with a small desk and six chairs, which was far from private and felt quite cramped for client meetings.

Even still, we gained a couple of valuable clients in that space. I connected with Chris Carr and Shannon Dyson, whose wives ran a commercial cleaning business. They needed assistance with bookkeeping and payroll. They became one of our first payroll-only clients. Chris was just starting Venture Motor Lines and through our conversation, I learned that he was looking for a small office space, much like ours. Morris Nutt, a client and friend, had a larger space available— half of a second floor for rent, about 2,500 square feet. Though it would put a bit of a financial strain on my budget, I believed in our potential for growth and embraced this opportunity with optimism. We moved to the new office and were able to pick up some work from BNI and do some QuickBooks consulting work to help with the cost.

It was a busy time. We were helping people with bookkeeping, getting tax returns done, and I was trying to prove myself to be the person they could rely on to do whatever it took to get the job done. Profitability wasn’t always guaranteed, but our commitment to getting the job done became the driving force behind our early success.

Expanding Services

It’s 2006 and we’re in this new, much bigger office. I bought a small bookkeeping book — a whopping $22,000 for 25 clients. Thankfully, we still have some of those clients today like Advanced Pools and Pam Stopher. It was kind of a hodgepodge of work, but they were great people to work with and it’s been amazing to see them grow.

Thinking back to our early days, one of our first mailing lists connected us with Martha Wilson. I met her at her home and discussed tax issues around her dining room table. She needed help with notices and getting her tax returns in order, especially with family and health concerns. Doug’s Quality Lawn Care was another gem from those early days. Doug, a former FedEx employee, started his own business, and I had the pleasure of working with him for years before he sold it and retired. These stories of growth and success are what made, and continue to make, my job so fulfilling.

Joining PASBA and Lots of New Ideas

One late night at the office, while browsing Thompson’s Forum, I stumbled upon a post about PASBA by Ray Busch. Intrigued, I clicked on the link, revealing a table of contents for books called, The Blueprint for Success. I thought, “I’d love to know how to do all these things.”

That curiosity led me to PASBA’s conference in Arizona where I encountered firms that were handling 100+ clients, pulling in a million dollars in revenue—something I hadn’t even considered remotely possible. At the time, I struggled to maintain 20 clients monthly, dealing with the challenges of collecting payments and chasing receivables just to meet payroll. It was a humbling and daunting experience, and it made me realize the complexities of being a business owner.

At this conference, I was introduced to the concept of a sales team. It seemed crazy to me that an accounting firm could have a salesperson who sold accounting, but wasn’t an accountant… but I listened intently to Tom Carroll, the sales director for Ed Hastreiter.

Inspired and hopeful, I returned and wrote 25 letters informing clients that we were going to a fixed-fee model. I was lucky that 23 of those clients accepted this change without question. The model was straightforward because every client needed a tax return or assistance with government-required processes. However, there was an opportunity for a more comprehensive approach. We aimed to actively contribute to our clients’ financial success, providing insights on maximizing earnings, minimizing taxes, and enhancing their financial understanding. This required a solid foundation of accurate and up-to-date books. Our proactive stance positioned us as strategic partners who were committed to their long-term success. This framework still guides us today, with added features, but the same core philosophy.

Trinity Center

At age 32, I still knew very little about running a business. Despite my doubts, the clients had unwavering confidence, and the team’s commitment to improvement made each day better than the last.

Looking back at our office in Trinity Center, you can start to see some familiar names among the people I brought on board. In 2008, we welcomed Rick Bowers, Jen, and Tammy, along with Ling. It’s pretty humbling to recall those early days.

It was around this time that we tried another concept from PASBA – lead generators. Judy Johnson would set appointments for us, we’d pay her fee, and then I’d run all those appointments, plus the ones we gained from networking. Realizing that I needed to spread out the work, I asked a long-time friend, Rick Bowers if running these appointments with me would be something he’d be interested in. Considering Rick’s background in big corporate America, especially in marketing, I thought this endeavor would suit him perfectly. Rick had an exceptional ability to connect with anyone. Those initial appointments we set were nothing short of intriguing, to say the least.

Rick found success with some excellent initial appointments that not only became long-term clients but were also an ideal fit for our firm. He had a genuine concern for the well-being of small businesses and quickly recognized the potential of introducing our services to them. Rick wholeheartedly believed in our model and our firm’s mission to help others thrive. From the beginning, he embraced the concept, surpassing his initial trial period and expressing his love for the impactful work. His dedication to the job was evident as he not only found excitement in the work but also saw the tangible difference we were making in people’s lives. Having Rick on board for all those years was a stroke of luck. It’s not often you hear of an accounting salesperson who stayed with a firm for 15 years, and I was truly blessed by his commitment.

We spent five years in that Trinity Center office and once again, we were popping at the seams. Chuck Hannaford, a good friend and client, suggested we move to an open office suite in Germantown. The space wasn’t much larger than our current office, but it had a much better layout. In our five years at Trinity Center, we doubled our profits and began to see true momentum, but it was once again time to move.

Forest Center

The move to Forest Center came with a wonderful group of employees. Right away we were lucky enough to hire Stephanie Fennell and Colleen Murphy, and we hired Jody Jordan and Fred Day not much thereafter. About a year after that, we were lucky enough to get Kim Pope and Debbie Warren. Mike Shaeffer joined us around a year before we moved out of that office as well.

Observing where they are today is remarkable. Mike began as a staff accountant, Kim was also a staff accountant, and Kacie, our former admin, now holds the position of our Client Success Manager.

We experienced some incredible growth along with a fair share of challenges at Forest Center. It was a period of constant learning as I navigated through software changes and implemented various ideas. True to my nature, I often threw wrenches into the mix, promising a quick fix in five minutes that inevitably turned into an hour and a half. Despite the ups and downs, those were truly wonderful times that brought our team closer together and made us stronger for the future.

Patrick Payroll

In 2009 when we were still at Trinity, we began recognizing a gap in the market. We wanted to establish ourselves as not just an accounting firm that handled payroll clients but as a dedicated payroll business. Hence, we initiated a separate division named Patrick Payroll.

My focus was on doing things differently and, more importantly, doing them exceptionally well. As always, the growth came with its fair share of challenges. Once again, we began to experience the struggle of accommodating our team at the Forest Center office. It was a process of figuring out how to sustain our growth momentum. We were one of the fastest-growing firms in PASBA by far, but still had a lot of things we had to figure out as a business.

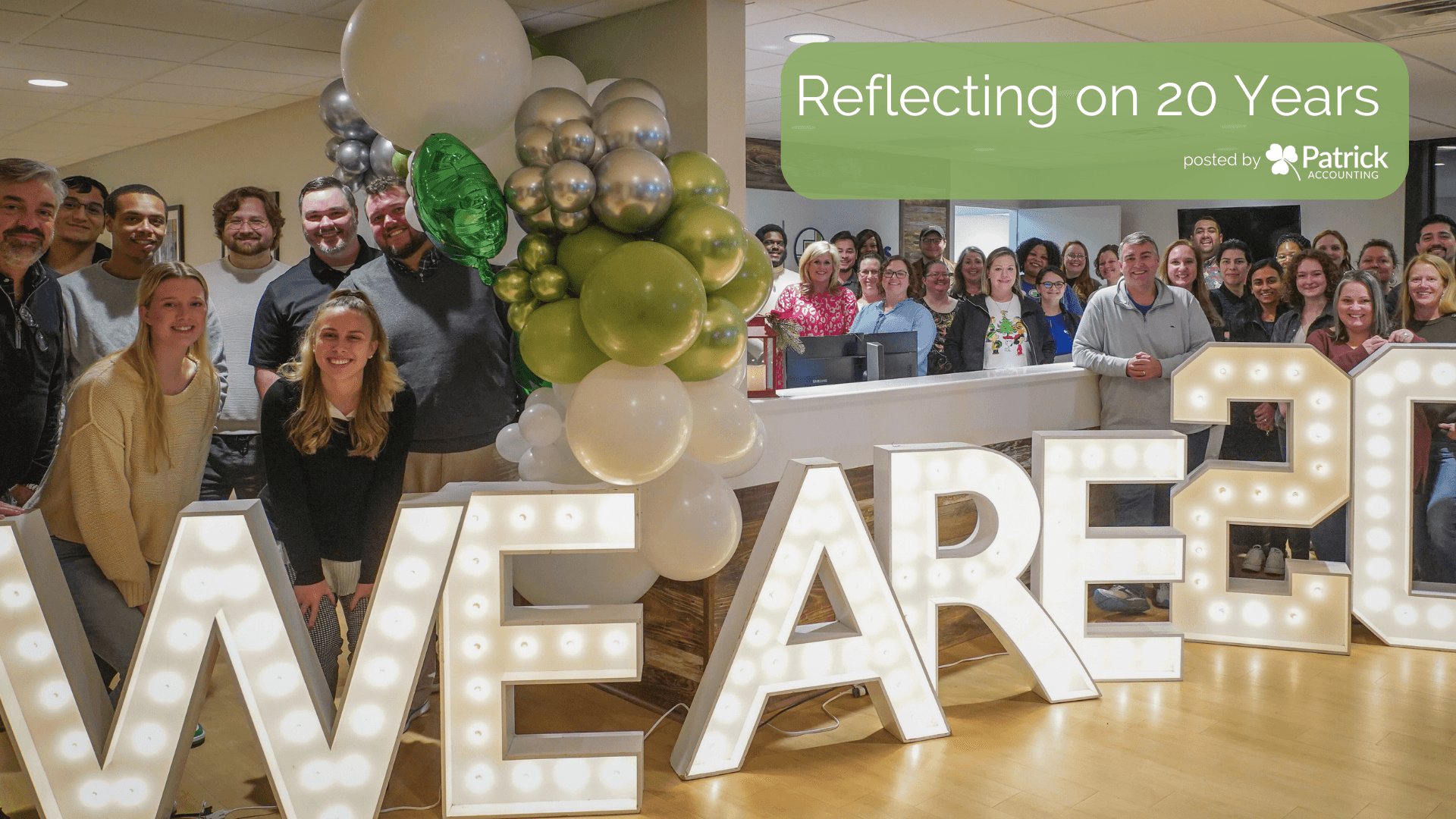

Our Team Today

Moving into our current office brought forth a wave of opportunities for sustained growth. Through it all, the key has been our incredible team. It’s hard to express gratitude for each member adequately. Working alongside such a dedicated group is a true blessing. From welcoming Lacey after working adjacent to her for years to celebrating Kacie’s return from the stay-at-home mom world, we hired so many wonderful people who still sustain our company today. Shelby joined us four years ago, and many of our awesome staff were soon to follow — Tomarro, Carolyn, Amber, Melissa, Robbie, Tara, Melissa, Cassie, Keishia, Kelli, Alex, and Rose, who is such an invaluable presence in our office that we’ve instated a strict “don’t yell at Rose” policy.

The list continues with Ms. Cheri, Sandy, Tucker, and a dynamic accounting group including Chantay, Kevin, Asher, Madison, Sydnie, Lani, Mallory, Allyson, and Pooja. The continuous influx of remarkable individuals is a perpetual blessing. I have to especially recognize our sales team – JD, Mark, Chance, and Pato. Each team member actively contributes to enhancing our business, embodying our values, and aligning with our mission to empower small businesses to succeed.

All About The Journey

From working out of my home with a nine-month-old to leading a team of incredible individuals, it’s hard to express the amount of gratitude I have for this remarkable journey. Our team and the myriad of wonderful clients have been the reason for our growth. I can recall several pivotal moments when clients chose to trust us with their businesses — like Pyros joining us when they were just opening their first restaurant and Walker Taylor walking into our Germantown office to say, “I need an accountant right now.” Clients like Roger Sapp, Mike Miller, and John Laish who have been with us for years, represent the diverse range of businesses we’ve been privileged to serve.

The common thread uniting us all is the shared commitment to helping each client thrive as a business owner. Our goal has been and continues to be, guiding and equipping them to be exemplary employers by keeping them informed and out of tax-related troubles.

A Huge Thank You

While the evolution of our business over the years has been substantial, our core principle remains unwavering – we love helping people. Leading this team is a blessing, and I express deep gratitude to everyone involved. My hope is for this business to endure for generations, leading the way in Memphis and the broader small business community. I genuinely wish for all of you to find joy and fulfillment in your work here, fostering a positive environment for both colleagues and clients. Thank you to each one of you– my clients, my employees, my family, and my friends — for contributing to our shared success. Here’s to another 20 years!

Topics: